Essay

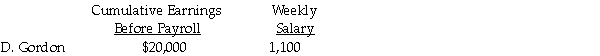

Sweeney's Recording Studio payroll records show the following information:  Assume the following:

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: The same deposit rules apply to employers

Q40: The Wages and Salaries Expense account would

Q41: The W-2 is the Wage and Tax

Q42: Mike's Door Service's payroll data for the

Q43: Record in the general journal the payroll

Q45: Form SS-4 is:<br>A) completed to obtain an

Q46: Using the information provided below, prepare a

Q47: An employer must always use a calendar

Q48: The employer's annual Federal Unemployment Tax Return

Q103: Prepare the general journal entry to record