Essay

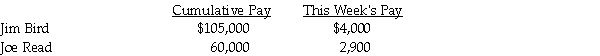

Compute the net pay for each employee listed below. Assume the following rates: FICA-OASDI 6.2% on a limit of $128,400; Medicare is 1.45%; federal income tax is 20%; state income tax is 5%; and union dues are $20.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Given the following payroll items you are

Q2: Greg's Auction House's payroll for April includes

Q3: A FUTA tax credit:<br>A) is given to

Q4: The amount withheld for FICA is based

Q5: The employee earnings record:<br>A) shows all employee

Q7: When an employee's earnings are greater than

Q8: For which of the following taxes is

Q9: Insurance paid in advance by employers to

Q10: Bill James earned $800 for the week.

Q11: When calculating the employee's payroll, the clerk