Multiple Choice

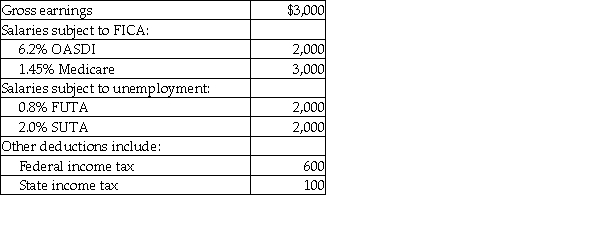

Greg's Auction House's payroll for April includes the following data:  What is the employee's portion of the taxes? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest whole dollar.)

What is the employee's portion of the taxes? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest whole dollar.)

A) $824

B) $868

C) $744

D) $700

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Given the following payroll items you are

Q3: A FUTA tax credit:<br>A) is given to

Q4: The amount withheld for FICA is based

Q5: The employee earnings record:<br>A) shows all employee

Q6: Compute the net pay for each employee

Q7: When an employee's earnings are greater than

Q8: For which of the following taxes is

Q9: Insurance paid in advance by employers to

Q10: Bill James earned $800 for the week.

Q11: When calculating the employee's payroll, the clerk