Multiple Choice

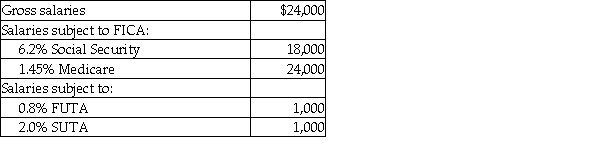

Bob's Cake House's payroll for April includes the following data:  The employer's payroll tax for the period would be: (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

The employer's payroll tax for the period would be: (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) $1,864.

B) $1,492.

C) $2,136.

D) $2,508.

Correct Answer:

Verified

Correct Answer:

Verified

Q128: Unemployment taxes are:<br>A) based on wages paid

Q129: Premiums for workers' compensation insurance may be

Q130: The taxable earnings column of the payroll

Q131: Bob's Auction House's payroll for April includes

Q132: The amount of federal income tax withheld

Q133: The Federal Insurance Contributions Act is better

Q134: Gross Earnings are the same as:<br>A) regular

Q135: A calendar quarter consists of:<br>A) 13 weeks.<br>B)

Q136: An employer can reduce the federal unemployment

Q138: Explain what is meant by the cumulative