Multiple Choice

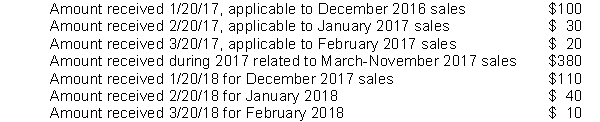

A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the 20th day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: A city levies a 2 percent sales

Q42: A city that has property taxes of

Q43: Unrestricted grant revenues with a time requirement

Q44: Under GAAP, income tax revenues should be

Q45: A city that has a 12/31 fiscal

Q47: If an entity elects to focus on

Q48: Under GAAP, property taxes levied in one

Q49: A city that has property taxes of

Q50: An anonymous benefactor has pledged to give

Q51: The City of Jolie maintains its books