Essay

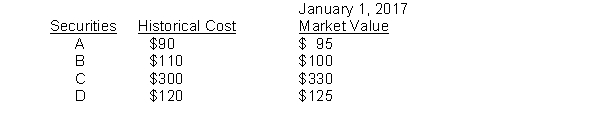

The City of Jolie maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the city's investment income and related transactions for the year 2017. The city has a 12/31 fiscal year-end. All of the City's investments are required to be reported at fair value. The beginning securities portfolio held by the general fund was as follows:  a.) Dividends received related to investments held in the general fund, $75.

a.) Dividends received related to investments held in the general fund, $75.

b.) On March 1, Security B is sold for $105.

c.) On April 1, Security E is purchased for $145

d.) On May 1 Security D is sold for $140.

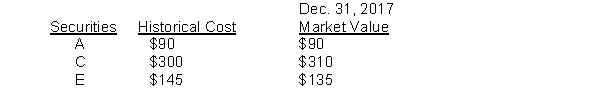

e.) On December 31, necessary adjusting entries are made to recognize appropriate amounts of gains/losses associated with the securities. The market values of the securities at year-end were as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Q46: A city levies a 2 percent sales

Q47: If an entity elects to focus on

Q48: Under GAAP, property taxes levied in one

Q49: A city that has property taxes of

Q50: An anonymous benefactor has pledged to give

Q52: For fund financial statements, the measurement focus

Q53: Under GAAP, property taxes levied in one

Q54: The revenue-recognition issues facing governments are generally

Q55: GASB suggests that income tax revenues should

Q56: Under the modified accrual basis of accounting,