Short Answer

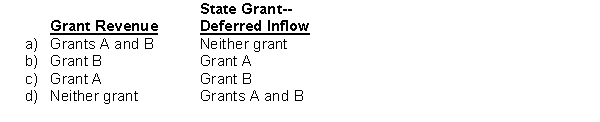

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under the modified accrual basis of accounting,

Q2: Gifts of capital assets are recorded in

Q3: Paul City received payment of two grants

Q5: In government-wide statements of activities are reported

Q6: Castle County reported the following transactions during

Q7: Ben City maintains its books and records

Q8: Revenues that cannot be classified as general

Q9: A government is the recipient of a

Q10: Under the accrual basis of accounting, gains

Q11: A city receives a federal grant which