Short Answer

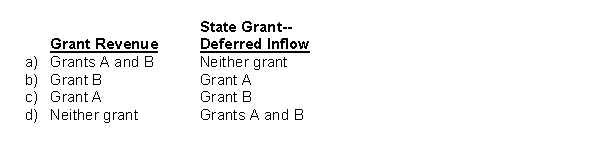

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under the modified accrual basis of accounting,

Q2: Gifts of capital assets are recorded in

Q4: Paul City received payment of two grants

Q5: In government-wide statements of activities are reported

Q6: Castle County reported the following transactions during

Q7: Ben City maintains its books and records

Q8: Revenues that cannot be classified as general

Q9: A government is the recipient of a

Q10: Under the accrual basis of accounting, gains

Q11: A city receives a federal grant which