Essay

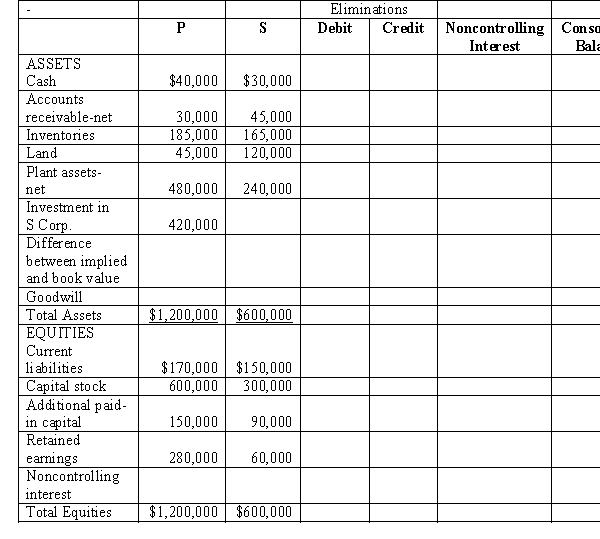

P Corporation paid $420,000 for 70% of S Corporation's $10 par common stock on December 31, 2016, when S Corporation's stockholders' equity was made up of $300,000 of Common Stock, $90,000 of Other Contributed Capital and $60,000 of Retained Earnings. S's identifiable assets and liabilities reflected their fair values on December 31, 2016, except for S's inventory which was undervalued by $60,000 and their land which was undervalued by $25,000. Balance sheets for P and S immediately after the business combination are presented in the partially completed work-paper below.  Required:

Required:

Complete the consolidated balance sheet workpaper for P Corporation and Subsidiary.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: On January 1, 2016, Pell Company and

Q28: If an entity is not considered a

Q29: On January 1, 2016, Pent Company and

Q30: Under the economic entity concept, consolidated financial

Q31: The primary beneficiary of a variable interest

Q32: IFRS defines control as:<br>A) the direct or

Q33: On January 1, 2016, Pell Company and

Q34: On December 31, 2016, Priestly Company purchased

Q35: One reason a parent company may pay

Q36: The Difference between Implied and Book Value