Multiple Choice

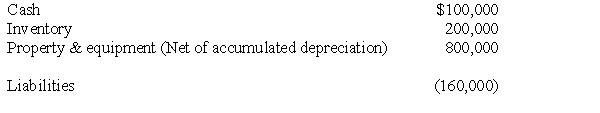

On May 1, 2016, the Phil Company paid $1,200,000 for 80% of the outstanding common stock of Sage Corporation in a transaction properly accounted for as an acquisition. The recorded assets and liabilities of Sage Corporation on May 1, 2016, follow:  On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

A) $0.

B) $112,000.

C) $140,000.

D) $28,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In a business combination, which of the

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q27: In a period in which an impairment

Q28: The first step in determining goodwill impairment

Q30: On January 1, 2013, Brighton Company acquired

Q31: A business combination is accounted for properly

Q32: In a business combination accounted for as

Q33: If the value implied by the purchase

Q34: Once a reporting unit is determined to