Essay

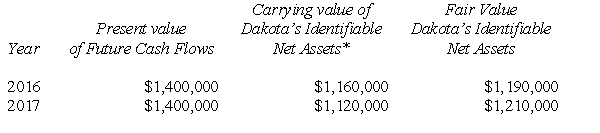

On January 1, 2013, Brighton Company acquired the net assets of Dakota Company for $1,580,000 cash. The fair value of Dakota's identifiable net assets was $1,310,000 on his date. Brighton Company decided to measure goodwill impairment using the present value of future cash flows to estimate the fair value of the reporting unit (Dakota). The information for these subsequent years is as follows:  * Identifiable net assets do not include goodwill.

* Identifiable net assets do not include goodwill.

Required:

A: For each year determine the amount of goodwill impairment, if any.

B: Prepare the journal entries needed each year to record the goodwill impairment (if any) on Brighton's books.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q27: In a period in which an impairment

Q28: The first step in determining goodwill impairment

Q29: On May 1, 2016, the Phil Company

Q31: A business combination is accounted for properly

Q32: In a business combination accounted for as

Q33: If the value implied by the purchase

Q34: Once a reporting unit is determined to

Q35: Maplewood Corporation purchased the net assets of