Essay

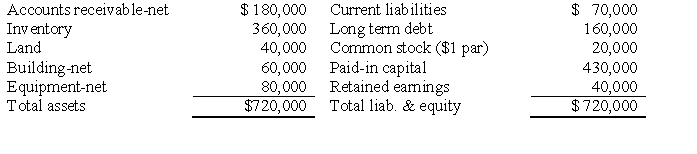

Maplewood Corporation purchased the net assets of West Corporation on January 2, 2016 for $560,000 and also paid $20,000 in direct acquisition costs. West's balance sheet on January

1, 2016 was as follows:  Fair values agree with book values except for inventory, land, and equipment, which have fair values of $400,000, $50,000 and $70,000, respectively. West has patent rights valued at $20,000.

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $400,000, $50,000 and $70,000, respectively. West has patent rights valued at $20,000.

Required:

A. Prepare Maplewood's general journal entry for the cash purchase of West's net assets.

B. Assume Maplewood Corporation purchased the net assets of West Corporation for $500,000 rather than $560,000, prepare the general journal entry.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: On January 1, 2013, Brighton Company acquired

Q31: A business combination is accounted for properly

Q32: In a business combination accounted for as

Q33: If the value implied by the purchase

Q34: Once a reporting unit is determined to

Q36: The following balance sheets were reported on

Q37: Condensed balance sheets for Rich Company and

Q38: P Company purchased the net assets of

Q39: The fair value of net identifiable assets

Q40: The fair value of net identifiable assets