Essay

Hopkins Company is considering the acquisition of Richfield, Inc. To assess the amount it might be willing to pay, Hopkins makes the following computations and assumptions.

A. Richfield, Inc. has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,700,000. The assets include office equipment with a fair value approximating book value, buildings with a fair value 25% higher than book value, and land with a fair value 50% higher than book value. The remaining lives of the assets are deemed to be approximately equal to those used by Richfield, Inc.

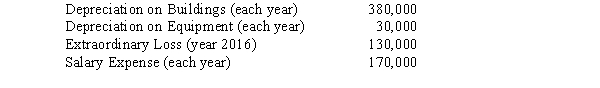

B. Richfield, Inc.'s pretax incomes for the years 2014 through 2016 were $470,000, $570,000, and $370,000, respectively. Hopkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future. However, it may need to consider adjustments for the following items included in pretax earnings:  C. The normal rate of return on net assets for the industry is 15%.

C. The normal rate of return on net assets for the industry is 15%.

Required:

A. Assume that Hopkins feels that it must earn a 20% return on its investment, and that goodwill is determined by capitalizing excess earnings. Based on these assumptions, calculate a reasonable offering price for Richfield, Inc. Indicate how much of the price consists of goodwill.

B. Assume that Hopkins feels that it must earn a 15% return on its investment, but that average excess earnings are to be capitalized for five years only. Based on these assumptions, calculate a reasonable offering price for Richfield, Inc. Indicate how much of the price consists of goodwill.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The two alternative views of consolidated financial

Q3: Estimating the value of goodwill to be

Q4: The third period of business combinations started

Q5: The parent company concept adjusts subsidiary net

Q6: Park Company acquired an 80% interest in

Q7: Stock given as consideration for a business

Q8: Which of the following statements is correct?<br>A)

Q9: The view that only the parent company's

Q10: The impairment standard as it relates to

Q11: The view that consolidated financial statements represent