Short Answer

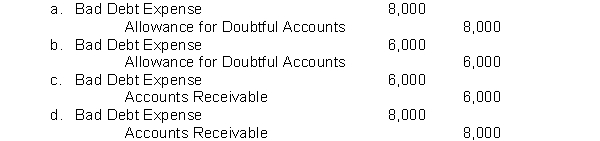

Nichols Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $200,000 and credit sales are $1,000,000. Management estimates that 4% of accounts receivable will be uncollectible. What adjusting entry will Nichols Company make if the Allowance for Doubtful Accounts has a credit balance of $2,000 before adjustment?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The accounts receivable turnover is needed to

Q4: The direct write-off method of accounting for

Q148: Schofield Retailers accepted $60,000 of Silver Bank

Q149: Erickson Company had a $300 credit balance

Q150: Presented here is basic financial information (in

Q151: Young Company lends Dobson industries $40,000 on

Q153: Which of the following is a way

Q156: During 2014 Wheeler Inc. had sales on

Q157: If the amount of uncollectible account expense

Q192: If a retailer accepts a national credit