Essay

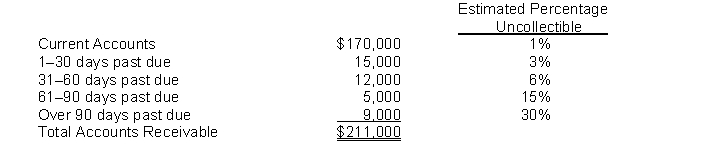

Erickson Company had a $300 credit balance in Allowance for Doubtful Accounts at December 31, 2014, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following:

Instructions

(a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense.

(b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $300 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts.

Correct Answer:

Verified

(a) Bad Debt Expense 6020

(a) Bad Debt Expense 6020

Allowance for...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Allowance for...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The accounts receivable turnover is needed to

Q4: The direct write-off method of accounting for

Q9: Which board(s) has(have) worked to implement fair

Q144: The following information is related to

Q146: Prepare journal entries to record the following

Q148: Schofield Retailers accepted $60,000 of Silver Bank

Q150: Presented here is basic financial information (in

Q151: Young Company lends Dobson industries $40,000 on

Q152: Nichols Company uses the percentage of receivables

Q153: Which of the following is a way