Multiple Choice

Use the following information for the next 3 questions.

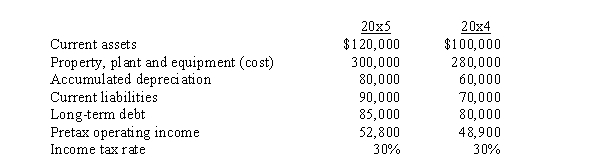

Chicago Division has a required rate of return of 15%. The weighted average cost of capital is 10%. Information for Chicago Divisions operations over the past 2 years follows.

-What was the Chicago Division ROI for 20x5 (rounded to nearest 0.1%) ?

A) 11.2%

B) 13.2%

C) 15.5%

D) 16.0%

Correct Answer:

Verified

Correct Answer:

Verified

Q46: A segment with an ROI of 30%

Q62: Which type of knowledge is most costly

Q72: Aiden's operating income was $100,000 and its

Q73: Which of the following responsibility centers can

Q74: A transfer pricing policy based on market

Q76: Use the following information for the next

Q78: Use the following information for the next

Q80: Use the following information for the next

Q81: The EVA for 2005 was<br>A) ($18,600)<br>B) ($12,840)<br>C)

Q82: Specific knowledge is I. More detailed than