Essay

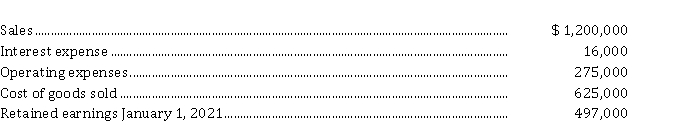

Austrian Limited is a private corporation reporting under ASPE. At December 31, 2021, its general ledger contained the following summary data:  Additional information:

Additional information:

1. In 2021 dividends of $ 35,000 were declared on July 1 and December 31 respectively. The dividends were paid on August 10, 2021 and January 15, 2022 respectively.

2. The company's tax rate is 33%.

Instructions

a) Determine the income tax expense and prepare a multi-step income statement for 2021.

b) Prepare a statement of retained earnings for 2021.

Correct Answer:

Verified

a) Income tax expens...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Authorized share capital is the amount of

Q73: Income taxes only affect the income statement.

Q129: Retained earnings are subtracted from share capital

Q195: Dividends in arrears are NOT considered a

Q196: Norton Corporation has the following shareholders equity

Q197: A credit balance in retained earnings represents<br>A)

Q200: Which of the following is NOT considered

Q201: Indicate the respective effects of the declaration

Q202: No par value shares are shares that

Q204: Trainor Corporation was organized on January 1,