Essay

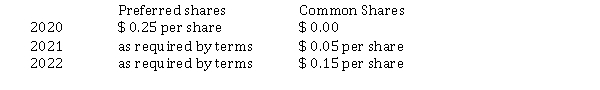

Trainor Corporation was organized on January 1, 2020. During its first year, the corporation issued 20,000 preferred shares with a $ 0.30 dividend entitlement and 200,000 common shares, both at $ 1 per share. At December 31, the corporation's year end, Trainor declared the following cash dividends:  Instructions

Instructions

a) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is not cumulative.

b) Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is cumulative.

b).

c) Journalize the declaration of the cash dividend at December 31, 2022 using the assumption of part

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Authorized share capital is the amount of

Q26: Return on equity will assist a company

Q49: A corporation is a legal entity that

Q187: The date on which a cash dividend

Q199: Austrian Limited is a private corporation reporting

Q200: Which of the following is NOT considered

Q201: Indicate the respective effects of the declaration

Q202: No par value shares are shares that

Q206: The following information is taken from the

Q208: During its first year of operations, Millwoods