Multiple Choice

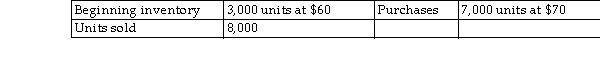

Given the following data, by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $20,000

B) Increase by $19,000

C) Increase by $20,000

D) Decrease by $19,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: The higher the inventory turnover figure, the

Q35: When inventory prices are increasing, the FIFO

Q36: The lower- of- cost- or- market rule

Q37: For a company using FIFO-and assuming rising

Q40: The following data was collected from the

Q42: If ending inventory for the year ended

Q43: If ending inventory on December 31, 2007,

Q44: Purchases returns and allowances and purchases discounts

Q78: The gross profit percentage expresses the relationship

Q107: An error in the valuation of beginning