Multiple Choice

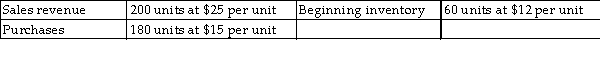

The following data was collected from the accounting records of Ambrose, Inc., which currently uses the FIFO method of valuing inventory. What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

A) Ending inventory is the same under both methods.

B) Ending inventory would have been $120 higher.

C) Ending inventory would have been $120 lower.

D) The difference cannot be determined using this information.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: When inventory prices are increasing, the FIFO

Q36: The lower- of- cost- or- market rule

Q37: For a company using FIFO-and assuming rising

Q39: Given the following data, by how much

Q42: If ending inventory for the year ended

Q43: If ending inventory on December 31, 2007,

Q44: Purchases returns and allowances and purchases discounts

Q45: On July 16, 2009, Martson and Co.

Q78: The gross profit percentage expresses the relationship

Q107: An error in the valuation of beginning