Essay

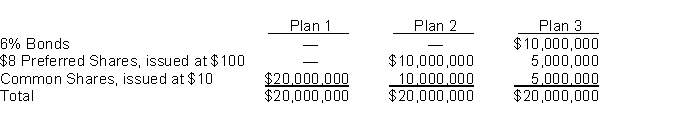

Three plans for financing a $20,000,000 corporation are under consideration by its organizers. The bonds will be issued at their face value and the income tax rate is estimated at 20%.  It is estimated that profit before interest and taxes will be $4,000,000.

It is estimated that profit before interest and taxes will be $4,000,000.

Instructions

For each plan, determine the expected profit and the earnings per share. Prior to obtaining financing there are no common shares outstanding.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: The current market value of the bond

Q51: From the standpoint of the issuing company,

Q52: Junk bonds are bonds that<br>A) are of

Q53: The following is a summarized balance sheet

Q54: Use the following exhibit for questions

Q56: Asgar Corporation issues a $350,000, 4%, 20-year

Q57: If bonds are issued at a discount,

Q58: Roblin Manufacturing Inc. intends to finance the

Q59: A gain on redemption is recorded when

Q60: Financial leverage refers to the practice of