Essay

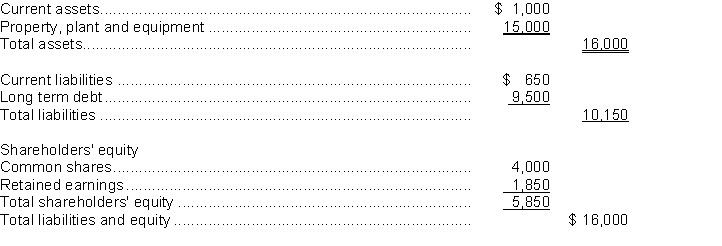

The following is a summarized balance sheet of Falcon Corporation at December 31, 2013. All amounts are in $000's.  Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Alternative 1: Issue a 20-year, $5,000,000 5% bond payable at face value.

Alternative 2: Issue 250,000 common shares at $20 each.

In Falcon's industry, a safe debt to total assets ratio is considered to be between 50% and 60%. Falcon's board of directors is risk adverse. Assume that the financing is made at the beginning of the year.

Instructions

a. Calculate the debt to total assets ratio under the two proposed financing methods.

b. Make a recommendation to Falcon on the better financing alternative and explain your choice.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: A $300,000 bond was retired at 98

Q49: Which of the following is a disadvantage

Q50: The current market value of the bond

Q51: From the standpoint of the issuing company,

Q52: Junk bonds are bonds that<br>A) are of

Q54: Use the following exhibit for questions

Q55: Three plans for financing a $20,000,000 corporation

Q56: Asgar Corporation issues a $350,000, 4%, 20-year

Q57: If bonds are issued at a discount,

Q58: Roblin Manufacturing Inc. intends to finance the