Essay

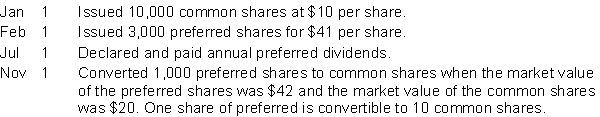

In its first year of operations, Arnold Corporation had the following transactions relating to its convertible preferred shares and common shares. The preferred dividend rate is $2 per share.  Instructions

Instructions

a. Journalize the transactions.

b. Indicate the amount to be reported for (1) preferred shares and (2) common shares at the end of the year.

Correct Answer:

Verified

a.

b. (1) Preferred shares: ...

b. (1) Preferred shares: ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Dividends are declared out of<br>A) Contributed Capital.<br>B)

Q44: If the board of directors has not

Q45: The effect of the declaration of

Q46: Retractable preferred shares<br>A) do not offer a

Q47: Dividends in arrears<br>A) are always considered a

Q49: A corporation is a legal entity that

Q50: Austrian Limited is a private corporation reporting

Q51: Which transaction will cause an increase in

Q52: Return on equity<br>A) is used by management

Q53: Under the Canada Business Corporations Act, a