Essay

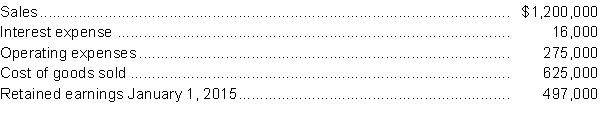

Austrian Limited is a private corporation reporting under ASPE. At December 31, 2015, its general ledger contained the following summary data:  Additional information:

Additional information:

1. In 2015 dividends of $35,000 were declared on July 1 and December 31 respectively. The dividends were paid on August 10, 2015 and January 15, 2016 respectively.

2. The company's tax rate is 33%.

Instructions

a. Determine the income tax expense and prepare a multi step income statement for 2015.

b. Prepare a statement of retained earnings for 2015.

Correct Answer:

Verified

a. Income tax expens...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: The effect of the declaration of

Q46: Retractable preferred shares<br>A) do not offer a

Q47: Dividends in arrears<br>A) are always considered a

Q48: In its first year of operations, Arnold

Q49: A corporation is a legal entity that

Q51: Which transaction will cause an increase in

Q52: Return on equity<br>A) is used by management

Q53: Under the Canada Business Corporations Act, a

Q54: The following selected transactions pertain to the

Q55: Declaration of cash dividends increases liabilities and