Multiple Choice

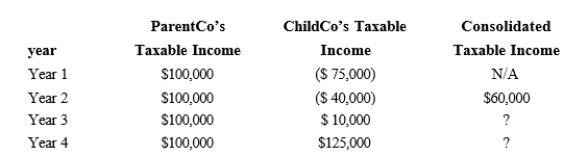

ParentCo purchased all of the stock of ChildCo on January 2, year 2, and the two companies filed consolidated returns for year 2 and thereafter. Both entities were incorporated in year 1. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  To what extent can ChildCo's year 1 losses be used by the group in year 4?

To what extent can ChildCo's year 1 losses be used by the group in year 4?

A) $135,000

B) $125,000

C) $75,000

D) $10,000

E) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q138: Parent's basis in the stock of Child,

Q139: LargeCo files on a consolidated basis with

Q140: Most of the Federal consolidated income tax

Q141: The Rack, Spill, and Ton corporations file

Q142: When a member departs from a consolidated

Q144: ParentCo owned 100% of SubCo for the

Q145: Cooper Corporation joined the Duck consolidated Federal

Q146: Match each of the following items with

Q147: Which of the following is not a

Q148: All affiliates joining in a newly formed