Essay

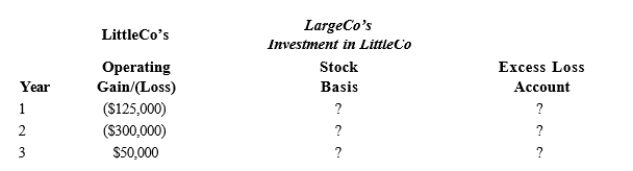

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, year 1, and it paid a $75,000 dividend to LargeCo at the end of both year 2 and year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of

December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, year 3. How will LargeCo account for this sale?

Correct Answer:

Verified

a. Year 1 Stock basis $275,000; excess l...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: Which of the following items is not

Q135: The rules for computing Federal consolidated taxable

Q136: In the current year, Parent Corporation provided

Q137: For each of the indicated tax

Q138: Parent's basis in the stock of Child,

Q140: Most of the Federal consolidated income tax

Q141: The Rack, Spill, and Ton corporations file

Q142: When a member departs from a consolidated

Q143: ParentCo purchased all of the stock of

Q144: ParentCo owned 100% of SubCo for the