Essay

In the current year, Parent Corporation provided advertising services to its 100% owned subsidiary, SubCo, under a

contract that requires no payments to Parent until next year. Both parties use the accrual method of tax accounting and a calendar tax year. The services that Parent rendered were valued at $250,000. In addition, Parent received

$20,000 of interest payments from SubCo. relative to an arm's length note between them.

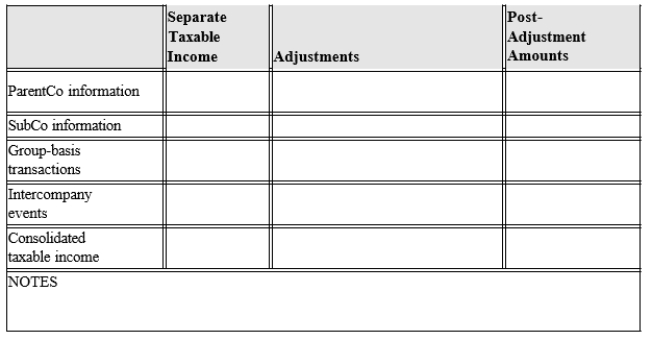

Including these transactions, Parent's taxable income for the year amounted to $400,000. SubCo reported $200,000 separate taxable income. Derive the group's consolidated taxable income using the format of Exhibit 8.3.

Correct Answer:

Verified

No eliminating adjustments are required ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: If subsidiary stock is redeemed or sold

Q132: Which of the following entities is eligible

Q133: Match each of the following items with

Q134: Which of the following items is not

Q135: The rules for computing Federal consolidated taxable

Q137: For each of the indicated tax

Q138: Parent's basis in the stock of Child,

Q139: LargeCo files on a consolidated basis with

Q140: Most of the Federal consolidated income tax

Q141: The Rack, Spill, and Ton corporations file