Multiple Choice

Figure 8-7

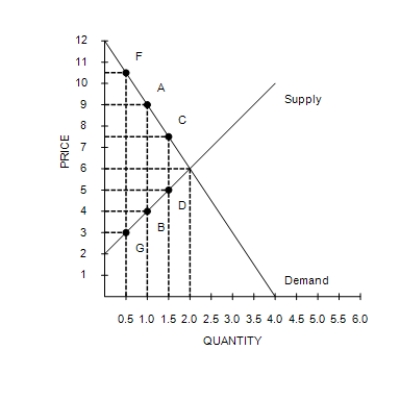

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-7. If the government changed the per-unit tax from $5.00 to $2.50, then the price paid by buyers would be $7.50, the price received by sellers would be $5, and the quantity sold in the market would be 1.5 units. Compared to the original tax rate, this lower tax rate would

A) increase government revenue and increase the deadweight loss from the tax.

B) increase government revenue and decrease the deadweight loss from the tax.

C) decrease government revenue and increase the deadweight loss from the tax.

D) decrease government revenue and decrease the deadweight loss from the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: When a tax is imposed on buyers,

Q91: Scenario 8-3<br><br>Suppose the market demand and market

Q92: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q93: Figure 8-9<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-9

Q94: Figure 8-2<br>The vertical distance between points C

Q96: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q97: If the government imposes a $3 tax

Q98: When a tax is imposed on a

Q99: Figure 8-4<br>Suppose the government imposes a $10

Q100: If a tax shifts the demand curve