Multiple Choice

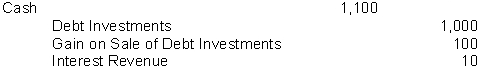

On January 1, U.K. Enterprise purchased as an investment a $1,000, 6% bond for $1,000. The bond pays interest on January 1 and July 1. The bond is sold on September 1 for $1,100 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1, 2014, JBT Company purchased

Q4: ischer Company has decided to begin accumulating

Q5: Dodd Company is considering an investment, which

Q7: inek Company deposited $12,500 annually for 6

Q8: Which of the following is the correct

Q9: avid Jones deposited $6,500 in an account

Q36: Trafton Company had the following transactions

Q44: For available-for-sale securities the unrealized gain or

Q66: The present value of $10000 to be

Q151: Reporting investments at fair value is<br>A) applicable