Essay

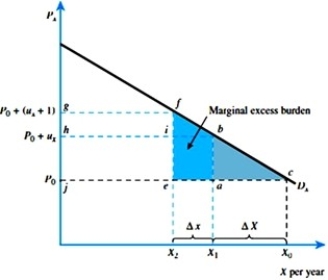

Refer to the figure below. Assume that the equation of Dx is P = 50 - 2Xd.

(A)If the original price of the good was $10 and a $4 tax was imposed, what is the tax income? Wha is the excess burden?

(A)If the original price of the good was $10 and a $4 tax was imposed, what is the tax income? Wha is the excess burden?

(B)How much marginal excess burden will be created if an additional dollar of tax is levied?

(C)How much additional tax is collected?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: "For goods that are unrelated in consumption,

Q3: Average cost pricing is<br>A)when AC = MC.<br>B)where

Q4: Suppose the demand for good X can

Q5: Refer to the figure below. The marginal

Q6: When the minimum marginal penalty for tax

Q8: Vertical equity incorporates the notion that<br>A)taxes paid

Q9: Refer to the figure below. When the

Q10: Optimal user fees are paid by everyone,

Q11: Consider a monopolist that has a total

Q26: Income is a poor measure of relative