Essay

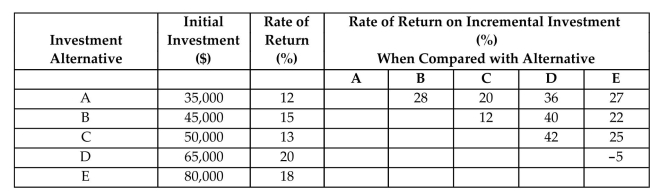

You are evaluating five investment projects. You already calculated the rate of return for each alternative

investment and incremental rate of return between the two-paired alternatives as well. In calculating the

incremental rate of return, a lower cost investment project is subtracted from the higher cost investment project.

All rate of return figures are rounded to the nearest integers.  (a) If all investment alternatives are mutually independent and the MARR is 10%,

(a) If all investment alternatives are mutually independent and the MARR is 10%,

which projects would be selected?

(b) If all investment alternatives are mutually exclusive and the MARR is 12%, which alternative should be

chosen?

(c) Suppose all investment alternatives are mutually exclusive but the MARR is 25%, which alternative should

be chosen?

Correct Answer:

Verified

(a) A,B,C,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Consider the following project's expected net cash

Q2: You are considering an investment that costs

Q3: Consider the following investment cash flow. <img

Q5: Consider the following project cash flows. <img

Q6: Consider a cash flow series for an

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3237/.jpg" alt=" Which of the

Q8: Find the rate of return for the

Q9: Consider the following two mutually exclusive investment

Q10: A manufacturing firm is considering two types

Q11: The following infinite cash flow has a