Essay

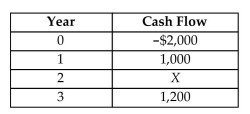

You are considering an investment that costs $2,000. It is expected to have a useful life of 3 years. You are very

confident about the revenues during the first and the third year, but you are unsure about the revenue in year 2.

If you hope to make at least a 10% rate of return on your investment ($2,000), what should be the minimum

revenue in year 2?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Consider the following project's expected net cash

Q3: Consider the following investment cash flow. <img

Q4: You are evaluating five investment projects. You

Q5: Consider the following project cash flows. <img

Q6: Consider a cash flow series for an

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3237/.jpg" alt=" Which of the

Q8: Find the rate of return for the

Q9: Consider the following two mutually exclusive investment

Q10: A manufacturing firm is considering two types

Q11: The following infinite cash flow has a