Essay

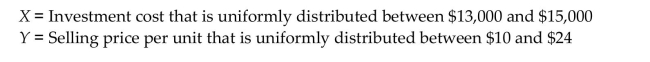

A new project will require $X in investment today and is expected to provide a net cash outflow of $1000(Y) for

the next two years where:  (a) Determine and simplify the NPV equation assuming the risk-free rate is 6%.

(a) Determine and simplify the NPV equation assuming the risk-free rate is 6%.

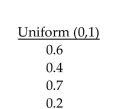

(b) Given the following sequence of uniform random deviates, calculate the first iteration for this NPV

equation. Note that the selling price, once determined at period 1 will be the same value will be assumed in

period 2. In statistical term, selling prices are perfectly positively correlated each other. Also assume that X and

Y are statistically independent.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: You are trying to analyze a risk-reward

Q3: Barbara Thompson is considering the purchase of

Q4: An engineering editor for a large publishing

Q5: Consider the following investment cash flows over

Q6: Langley Inc. has just invested $600,000 in

Q7: Assume a project is expected to produce

Q8: As a marketing manager for a large