Essay

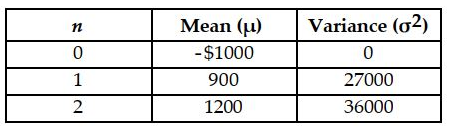

Assume a project is expected to produce the following cash flows in each year, each cash flow is independent of one another, each cash flow is gamma distributed, the risk-free rate is 5 % , and the MARR =15% .

(a) Calculate the expected net present value

(b) Calculate the standard deviation of the net present value

(c) Determine the probability that the NPV will be less than 600 .

(d) Determine the probability that the NPV will lie between 800 and 1200 .

Correct Answer:

Verified

(a) 11ec785f_88dd_66c1_98de_a93b2ebe9677...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: You are trying to analyze a risk-reward

Q2: A new project will require $X in

Q3: Barbara Thompson is considering the purchase of

Q4: An engineering editor for a large publishing

Q5: Consider the following investment cash flows over

Q6: Langley Inc. has just invested $600,000 in

Q8: As a marketing manager for a large