Essay

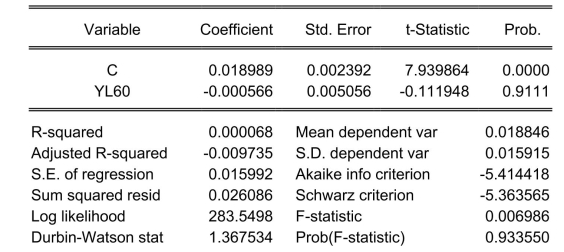

The neoclassical growth model predicts that for identical savings rates and population growth rates, countries should converge to the per capita income level. This is referred to as the convergence hypothesis. One way to test for the presence of convergence is to compare the growth rates over time to the initial starting level, i.e., to run the regression , where is the average annual growth rate of GDP per worker for the 1960-1990 sample period, and is GDP per worker relative to the United States in 1960. Under the null hypothesis of no convergence, , implying ("beta") convergence. Using a standard regression package, you get the following output: Dependent Variable: G6090

Method: Least Squares

Date: 07/11/06 Time: 05:46

Sample: 1104

Included observations: 104

White Heteroskedasticity-Consistent Standard Errors & Covariance

You are delighted to see that this program has already calculated p-values for you.

However, a peer of yours points out that the correct p-value should be 0.4562.

Who is right?

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Consider the sample regression function

Q23: Imagine that you were told that

Q24: Assume that your population regression function

Q25: (continuation from Chapter 4) Sir Francis

Q26: (Requires Appedix material and Calculus) Equation

Q29: Your textbook discussed the regression model

Q30: (continuation from Chapter 4, number 3)You

Q31: The only difference between a one- and

Q31: The proof that OLS is BLUE

Q32: In general, the t-statistic has the