Multiple Choice

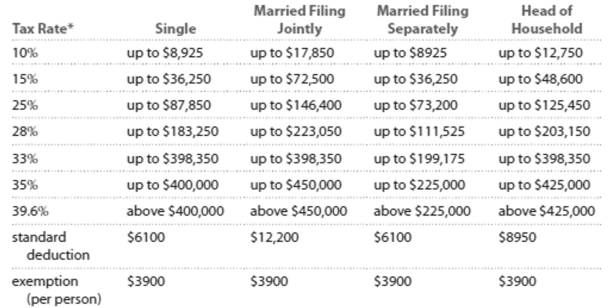

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

" Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Caitlin is single and earned wages of $32,988. She received $300 in interest from a savings account. She contributed $479 to a tax-deferred retirement plan. She had $530 in itemized deductions from

Charitable contributions. Calculate her gross income.

A) $32,279

B) $33,288

C) $33,767

D) $32,809

Correct Answer:

Verified

Correct Answer:

Verified

Q201: Solve the problem.<br>-Budget Summary for the

Q202: Use the compound interest formula for compounding

Q203: Solve.<br>-Calculate the monthly payment for a loan

Q204: Provide an appropriate response.<br>-If net income is

Q205: Write the word or phrase that best

Q207: Solve the problem. Refer to the table

Q208: Provide an appropriate response.<br>-A _ represents a

Q209: Answer the question.<br>-You put $422 per month

Q210: Provide an appropriate response.<br>-Which of the following

Q211: Assume you have a balance of $3200