Multiple Choice

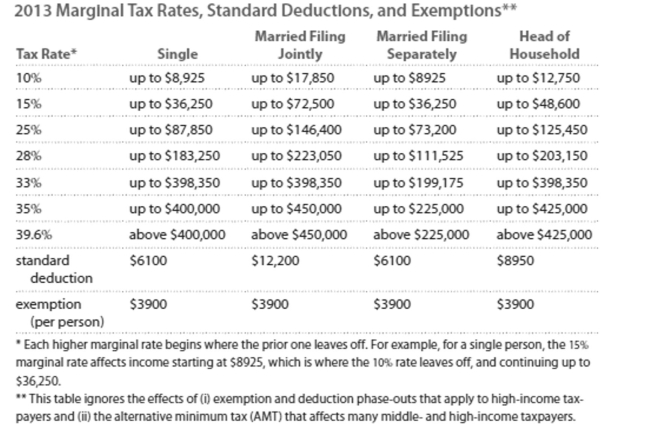

Solve the problem. Refer to the table if necessary.

-Jim earned wages of $89,118, received $5002 in interest from a savings account, and contributed $ 6342 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $8797. Find his adjusted gross income.

A) $75,081

B) $83,878

C) $100,462

D) $87,778

Correct Answer:

Verified

Correct Answer:

Verified

Q202: Use the compound interest formula for compounding

Q203: Solve.<br>-Calculate the monthly payment for a loan

Q204: Provide an appropriate response.<br>-If net income is

Q205: Write the word or phrase that best

Q206: Solve the problem. Refer to the

Q208: Provide an appropriate response.<br>-A _ represents a

Q209: Answer the question.<br>-You put $422 per month

Q210: Provide an appropriate response.<br>-Which of the following

Q211: Assume you have a balance of $3200

Q212: Solve the problem.<br>-Suppose the government has a