Multiple Choice

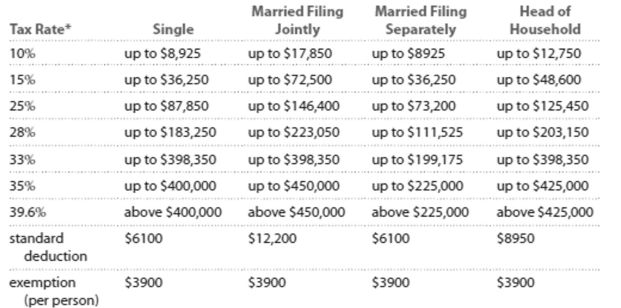

Solve the problem. Refer to the table if necessary.

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four

Exemptions for themselves and two children. They contributed $3364 to their tax-deferred

Retirement plans, and their itemized deductions total $10,516. Find their taxable income.

A) $62,442

B) $49,342

C) $56,070

D) $51,926

Correct Answer:

Verified

Correct Answer:

Verified

Q232: Solve the problem.<br>-You just put $4399 in

Q233: Solve the problem. Refer to the table

Q234: Answer the question.<br>-You must decide whether to

Q235: Use the given stock table to

Q236: Use the given stock table to answer

Q238: Evaluate or simplify the following the

Q239: Compute the total and annual returns

Q240: Solve the problem. Refer to the table

Q241: Solve the equation for the unknown

Q242: Decide whether the statement makes sense. Explain