Multiple Choice

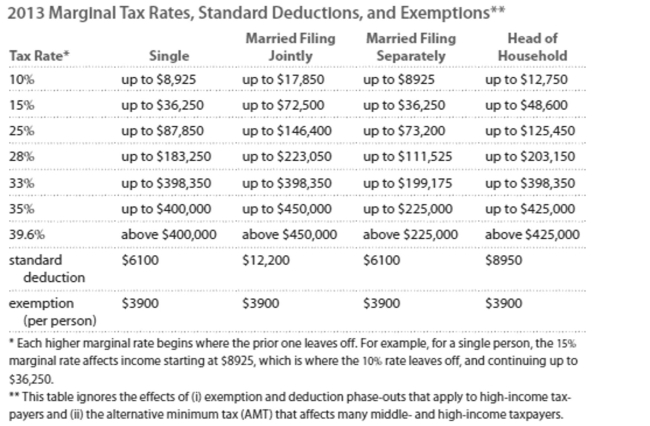

Solve the problem. Refer to the table if necessary.

-John is married filing separately with taxable income of $141,766. Calculate the amount of tax owed.

A) $32,520

B) $41,207

C) $34,939

D) $33,427

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q228: Write the word or phrase that best

Q229: Solve the problem. Refer to the

Q230: Write the word or phrase that best

Q231: Determine whether the spending pattern described is

Q232: Solve the problem.<br>-You just put $4399 in

Q234: Answer the question.<br>-You must decide whether to

Q235: Use the given stock table to

Q236: Use the given stock table to answer

Q237: Solve the problem. Refer to the

Q238: Evaluate or simplify the following the