Multiple Choice

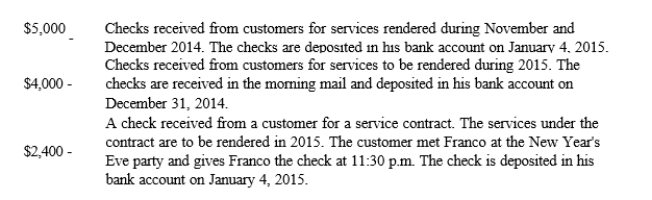

Franco is owner and operator of a cleaning service who uses the accrual method of accounting. He receives the following payments on December 31, 2014, the last business day of his tax year:  How much of the $11,400 collected by Franco on December 31 must be included in his 2014 gross income?

How much of the $11,400 collected by Franco on December 31 must be included in his 2014 gross income?

A) $ 5,000

B) $ 6,400

C) $ 7,400

D) $ 9,000

E) $11,400

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Patti sells a painting that has a

Q3: Ruth purchased an annuity contract for $10,000.

Q11: Amanda, who is single, owns 40% of

Q14: Angelica has the following capital gains and

Q19: Ursula owns an annuity that pays her

Q19: How much gross income does Ron have

Q74: For any unrecovered portion of an annuity

Q108: Darnel owns 10% of the stock in

Q128: Janelle receives a sterling silver tea set

Q152: The holding period for receiving long-term capital