Essay

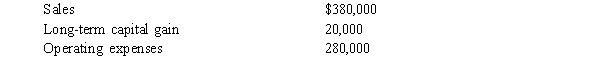

Amanda, who is single, owns 40% of the Sherwood Partnership. During the current year, Sherwood has the following results:  Amanda withdraws $30,000 from the partnership. In addition, Amanda has a $30,000

Amanda withdraws $30,000 from the partnership. In addition, Amanda has a $30,000

a. long-term capital loss from the sale of an investment. What is Amanda's gross income from this information? Explain and show your calculations.

Assume that in the next year, Sherwood Publishing has $80,000 of ordinary income,

b. Amanda has a $24,000 short-term capital gain and taxable income from other sources of $20,000. What is her adjusted gross income? Explain and show your calculations.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Patti sells a painting that has a

Q3: Ruth purchased an annuity contract for $10,000.

Q7: Arnold is the President of Conrad Corporation.

Q8: On January 1, Sandi borrows $40,000 from

Q12: Frank and Lilly are negotiating a divorce

Q14: Angelica has the following capital gains and

Q15: Franco is owner and operator of a

Q19: Ursula owns an annuity that pays her

Q128: Janelle receives a sterling silver tea set

Q143: Imputed interest rules and policies include which