Multiple Choice

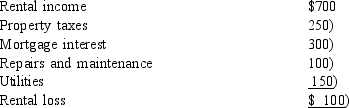

Mike and Pam own a cabin near Teluride, Colorado. In the current year the cabin was rented for 8 days to friends. Mike and Pam used the cabin a total of 82 days during the same year. After allocating the expenses between personal and rental use, the following rental loss was determined:  How should Mike and Pam report the rental income and expenses for last year?

How should Mike and Pam report the rental income and expenses for last year?

A) Report the $100 loss for AGI.

B) Include the $700 in gross income, but no deductions are allowed.

C) Only expenses up to the amount of $700 rental income may be deducted.

D) Report the interest $300) and taxes $250) as itemized deductions and the other expenses for AGI.

E) No reporting for the rental activity is necessary.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Davis owns and operates a convenience store

Q43: Tom, Dick, and Harry operate Quality Stores.

Q44: Discuss whether the following persons are currently

Q44: Walter pays a financial adviser $2,100 to

Q47: Cornelius owns a condominium in Orlando. During

Q125: Michelle is a bank president and a

Q129: Jackie recently retired from the U.S. Coast

Q134: Income tax accounting methods and financial accounting

Q158: Which of the following payments are currently

Q163: Angela is an accrual basis taxpayer. On