Essay

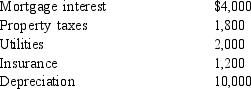

Cornelius owns a condominium in Orlando. During the year, Cornelius uses the condo a total of 25 days. The condo is also rented to vacationers for a total of 75 days and generates rental income of $9,000. Cornelius incurs the following expenses:  Determine Cornelius's deduction related to the condominium. Indicate the amount of each expense that can be deducted and how it would be deducted.

Determine Cornelius's deduction related to the condominium. Indicate the amount of each expense that can be deducted and how it would be deducted.

Correct Answer:

Verified

The rental is a vacation home because Co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Mike and Pam own a cabin near

Q43: Tom, Dick, and Harry operate Quality Stores.

Q44: Walter pays a financial adviser $2,100 to

Q44: Discuss whether the following persons are currently

Q48: Girardo owns a condominium in Key West.

Q49: Shaheen owns 2 rental properties. She hires

Q50: Which of the following individuals is involved

Q72: Which of the following expenditures or losses

Q113: Which of the following is/are trade or

Q125: Michelle is a bank president and a