Multiple Choice

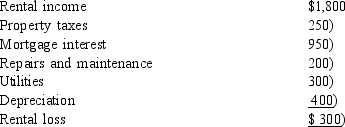

Jack and Cheryl own a cabin near Copper Mountain, Colorado. During the year, Jack and Cheryl rent the cabin for 30 days to friends for $1,800. Jack and Cheryl use the cabin a total of 60 days during the year. After making the appropriate allocation of planned expenses between personal and rental use, the following rental loss was determined:  How should Jack and Cheryl report the rental income and expenses for the forthcoming year? I. Only expenses up to the amount of $1,800 rental income may be deducted for the year. II. Only depreciation in the amount of $100 may be deducted. III. The amount of the disallowed depreciation deduction $300) can be carried forward. IV. Nothing needs to be reported.

How should Jack and Cheryl report the rental income and expenses for the forthcoming year? I. Only expenses up to the amount of $1,800 rental income may be deducted for the year. II. Only depreciation in the amount of $100 may be deducted. III. The amount of the disallowed depreciation deduction $300) can be carried forward. IV. Nothing needs to be reported.

A) Only statement I is correct.

B) Statements II and III are correct.

C) Statements I, II and III are correct.

D) Statements III and IV are correct.

E) Statements I, II, III, and IV.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: James rents his vacation home for 30

Q15: Claire and Harry own a house on

Q17: Discuss whether the following expenditures meet the

Q45: If someone provides a taxpayer with either

Q65: Michael operates an illegal cock fighting business.

Q82: Explain the rationale for disallowing the deduction

Q95: Pamela owns the building where her plumbing

Q114: The all-events test requires that<br>I.All events have

Q142: In order for a taxpayer to reduce

Q160: Safina is a high school teacher. She