Multiple Choice

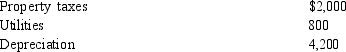

James rents his vacation home for 30 days during the year and lives in it personally for 10 days. He receives rents of $4,000 and incurs the following expenses before allocation:  What is James' income or loss from the rental property?

What is James' income or loss from the rental property?

A) $ - 0 -

B) $1,000 loss

C) $1,250 loss

D) $1,000 income

E) $1,200 income

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Sergio purchases $3,000-worth of supplies from a

Q14: Jack and Cheryl own a cabin near

Q15: Claire and Harry own a house on

Q17: Discuss whether the following expenditures meet the

Q45: If someone provides a taxpayer with either

Q77: Sheila extensively buys and sells securities. The

Q82: Explain the rationale for disallowing the deduction

Q95: Pamela owns the building where her plumbing

Q142: In order for a taxpayer to reduce

Q160: Safina is a high school teacher. She