Multiple Choice

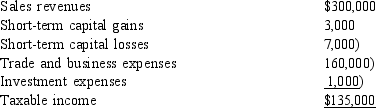

Luisa, Lois, and Lucy operate a boutique named Mariabelle's Dreams. Based on advice from Luisa's sister, an accountant, the three form a partnership. Luisa owns 40% and Lois and Lucy each own 30%. For the year, Mariabelle's Dreams reports the following:  What amount will Mariabelle's Dreams report to Luisa as her ordinary income from the partnership?

What amount will Mariabelle's Dreams report to Luisa as her ordinary income from the partnership?

A) $54,000

B) $54,400

C) $54,800

D) $55,600

E) $ 56,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: William, a CPA, owns a 75% interest

Q18: Sales of property between a partner who

Q24: During the current year,Mars Corporation receives dividend

Q30: During the current year,Swallowtail Corporation receives dividend

Q53: Pablo owns 30% of Cancun Company, an

Q78: Salem Inc. is an electing S corporation

Q79: Rayburn owns all the shares of Newcastle

Q84: Lavery Corporation has two equal shareholders, and

Q90: Sean Corporation's operating income totals $200,000 for

Q92: Higlo Paints is a partnership that reports