Short Answer

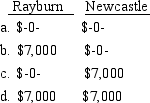

Rayburn owns all the shares of Newcastle Corporation that operates as an S corporation. Rayburn's basis in the stock is $15,000. During the year he receives a cash distribution of $22,000 from Newcastle. What must Rayburn and Newcastle report as income from the cash distribution?

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Sales of property between a partner who

Q24: During the current year,Mars Corporation receives dividend

Q40: Valmont owns 98% of the stock of

Q53: Pablo owns 30% of Cancun Company, an

Q75: Global Corporation distributes property with a basis

Q78: Salem Inc. is an electing S corporation

Q84: Lavery Corporation has two equal shareholders, and

Q84: Luisa, Lois, and Lucy operate a boutique

Q90: Sean Corporation's operating income totals $200,000 for

Q92: Higlo Paints is a partnership that reports