Multiple Choice

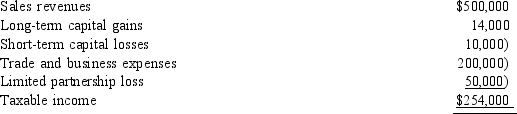

Martin and Joe are equal partners in Ferrell Company. For the current year, Ferrell Company reports the following items of income and expense:  In addition to his Ferrell Company earnings, Martin has other income of $35,000. Included in the $35,000 is a $10,000 loss from the sale of land held as an investment. Martin's adjusted gross income is:

In addition to his Ferrell Company earnings, Martin has other income of $35,000. Included in the $35,000 is a $10,000 loss from the sale of land held as an investment. Martin's adjusted gross income is:

A) $162,000

B) $167,000

C) $172,000

D) $187,000

E) $192,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A corporation's excess charitable contributions over the

Q15: Howard is a partner in the Smithton

Q16: Brooks Corporation distributes property with a basis

Q18: Sensor Corporation was formed and began operations

Q23: Tippecanoe Corporation has the following income and

Q33: Regarding a partnership, which of the following

Q55: Olivia owns 40% of Addison Company, a

Q77: Which of the following items are included

Q82: Roger owns 25% of Silver Trucking, a

Q91: Ed's adjusted basis in his partnership interest