Short Answer

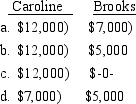

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation. Caroline's basis in the stock is $32,000. What must Caroline and Brooks report as income loss) upon the liquidation of Brooks?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If a sole proprietorship has a net

Q5: A corporation's excess charitable contributions over the

Q18: Sensor Corporation was formed and began operations

Q20: Martin and Joe are equal partners in

Q39: Hawkins Corporation has $50,000 of taxable income

Q55: Olivia owns 40% of Addison Company, a

Q59: Since Wisher, Inc. owns 80% of Patriot,

Q77: Which of the following items are included

Q82: Roger owns 25% of Silver Trucking, a

Q87: Harrison Corporation sells a building for $330,000