Short Answer

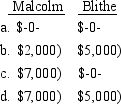

Malcolm receives a liquidating distribution of land with a fair market value of $14,000 and a basis of $19,000 from Blithe Corporation, an S corporation. Malcolm's basis in the stock is $21,000. What must Malcolm and Blithe report as income loss) from the property distribution?

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Discuss two tax-planning techniques that can be

Q22: Passive activity loss limitation rules do not

Q22: Byron is a partner in the Dowdy

Q43: Roger owns 65% of Silver Trucking, a

Q47: With the exception of personal service and

Q51: The Polaris S Corporation has operating income

Q60: When a partner receives a cash distribution

Q62: Dorothy operates a pet store as a

Q65: The Serenity Corporation distributes $200,000 in cash

Q79: A corporation's calculation of the maximum allowable